Back to In the Press

JUN 07, 2021

FX Forward Interpolation is not a straight line – is it?

New Change FX Launches FX Forward Benchmark Curves for Broken Dates

New Change FX is pleased to announce the launch of regulated foreign exchange benchmark curves for non-standard, or broken dates.

Since the launch of our benchmark rates for standard tenors it has become apparent that buyside clients are very often exposed to currency risk on non-standard tenor dates, and we are therefore pleased to be able to offer broken date benchmarks in a universe of pairs.

Market participants have always struggled to benchmark forwards, in particular on broken dates. This is because the only available data on forwards are the generic, pillar, ‘on the run’ or standard tenors. There is of course some additional information from IMM dates. These tenors, however, are broadly for the purpose of market makers clearing their risk with each other. Most dates needed by end users are broken dates that meet the specific need of the customer; to match a liability or hedge a future cashflow.

Forward traders distil a considerable amount of risk factors into the prices that they quote to the market. Two yield curves, cross currency basis, jump dates, special dates, turns, supply & demand as well as personal bias all play a part.

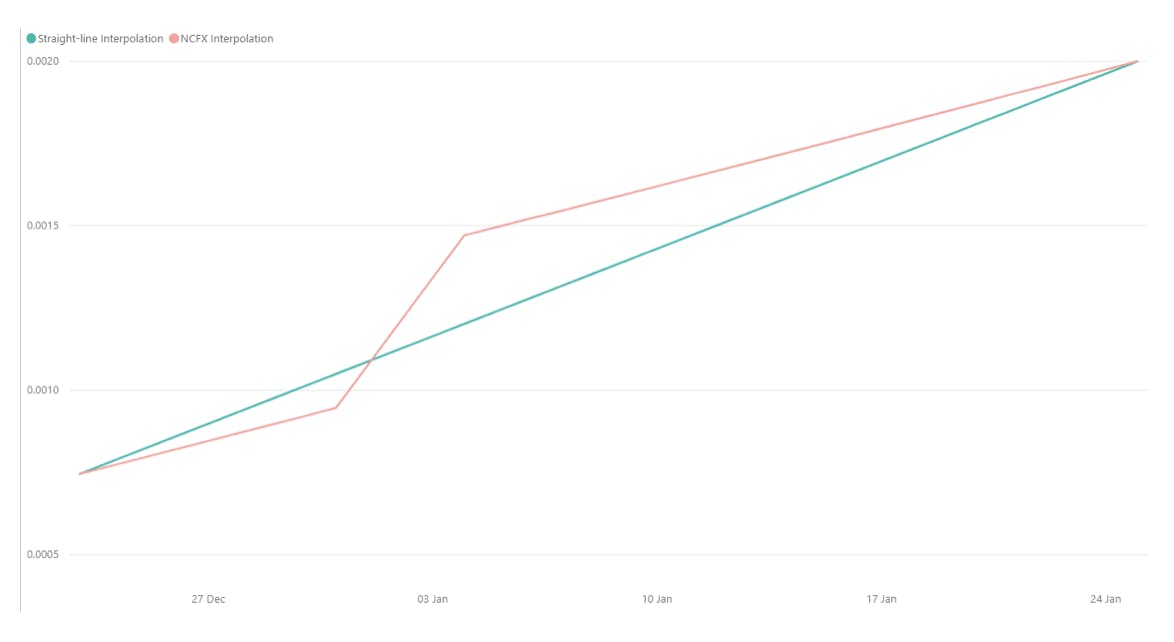

To view the forward curve correctly one cannot simply interpolate between all the standard tenors and assume that any given date will be near this line. It is possible, however, to reconstruct the curve in the same way a forward trader looks at the risk of a portfolio. By undertaking an enormous amount of research and working with forward traders, NCFX has been able to pinpoint special dates with accuracy. Once those dates are known NCFX can deliver an accurate benchmark across the entire curve.

The implication for users of TCA is clear. By using straight line interpolation to assess transaction costs around turn events, errors can be substantial as this chart of EURUSD points around year-end 2020 shows:

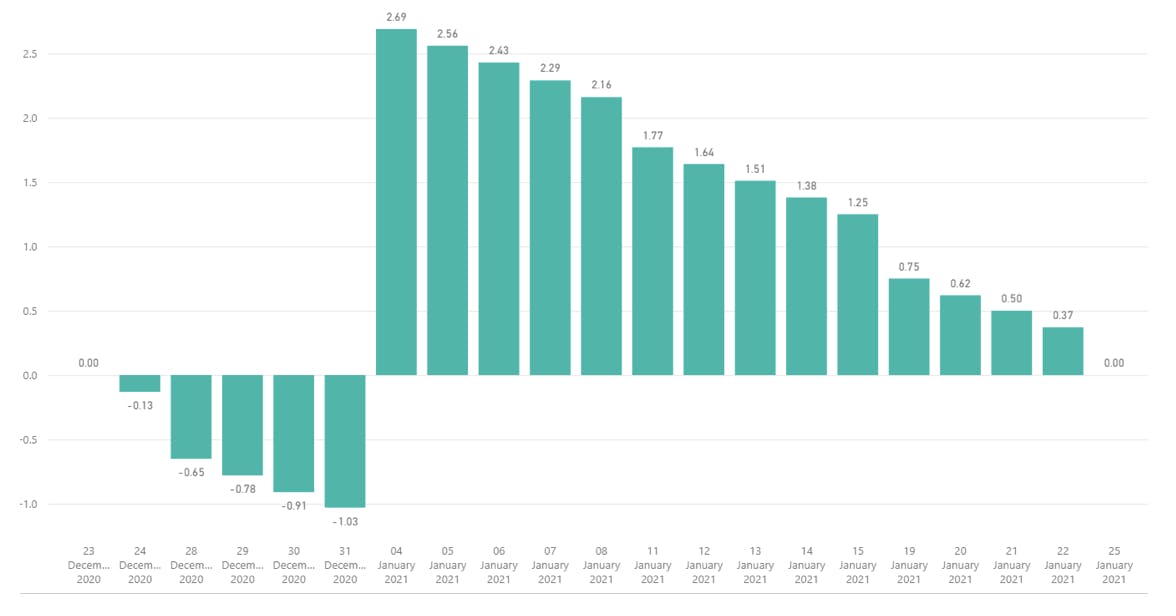

In terms of basis points, the error becomes crystal clear:

Considering that swaps are trading at spreads of 0.4bps or less, a 2.5bp error in the calculation of cost creates a significant error in the TCA.

Being able to quickly and easily access a regulated benchmark for the FX Forward curve is a significant advantage for traders on both the buy and sell-side of the market. The ability to access data derived from streaming forward prices and benchmarked standard tenor data offers a significant improvement in transparency.

Data is available to NCFX TCA clients as part of the service, to API users and to users requiring a desktop calculator via the web.

New Change FX is an Authorised Benchmark Administrator

For more information please contact NCFX at info@newchangefx.com

Corporate Responsibility. NCFX adheres to the principles set out in the following international codes of ethical conduct: OECD Guidelines for Multinational Enterprises, UN Global Compact, UN Guiding Principles on Business and Human Rights, ILO Conventions: Child Labour (C138, C182); Forced Labour (CO29, C105); Discrimination (C100, C111); Freedom of Association (CO87, C098).

© 2025 New Change FX. All rights reserved.