Back to Market Insights

NOV 23, 2023

How much are you overpaying for your FX forward transactions?

How much are you overpaying for your FX forward transactions?

When thinking about FX markets, people tend to focus on spot transactions. These may be the most easily understood segment, but are they the most important when considering the cost of transactions?

The FX market has a turnover exceeding USD 7.5 trillion per day. Trading in spot accounts for less than 30% of that. We find most day-to-day spot transactions by asset managers are generally small, at less than USD 5 million. The main driver of large volume transactions is the execution of hedging using swaps.

Looking at available forwards data needed for such transactions, we see that almost all buy-side firms use a form of straight-line interpolation to assess the price for a given date in the future. Whether this data is gathered from data platforms, or the interpolation is done in house, the result is the same; the points for any non-standard date vary from those being traded in the market. We can see from our TCA business that executing in such an information fog is often a costly problem.

The assumption has been that the asymmetric information between price maker and taker makes little difference in the real world, especially if a good and trusting relationship exists. Sadly, such an assumption is often misplaced in a market with such high stakes. The absence of accurate data to feed most TCA engines means that the impact of this information fog remains undisclosed. The TCA matches the data, and the costs look low because the costs are weighed with an inaccurate scale and then checked against the same scale. This approach to TCA both hides costs that need to be addressed and misses savings that can be realised through a more informed approach.

Why is there a difference between straight line and ‘market’ points?

Market makers use a complex variety of inputs to calculate the forward points required for a given date in the future. These include interest rates, basis, special dates, inventory, and more. Straight-line interpolation simply links dates on which a transparent market exists (standard tenors such as 1 month or 2 months) with a straight line. This straight line misses the granularity that exists in the underlying market. NCFX Forwards365 provides that missing granularity, building curves like those of an independent market maker, for every day out to one year.

How much cold, hard cash are we talking?

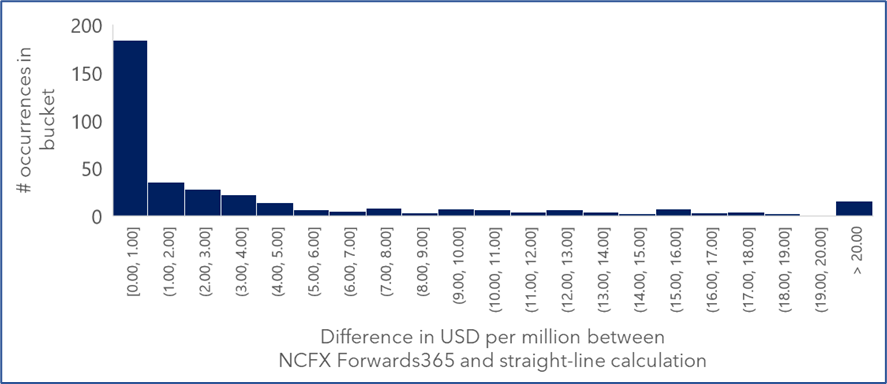

The charts covering EURUSD, AUDUSD, and GBPUSD below show that differences in USD per million dollars traded between NCFX Forwards365 and straight-line calculation can be significant. In EURUSD and AUDUSD, we see more than 10% of transactions are at greater than 20 USD per million traded in additional cost.

Where a firm is rolling hedges through turn dates, the differences become even more pronounced: up to USD 42 per million dollars traded in AUDUSD and USD 49 in GBPUSD. The effect in EURUSD is even more pronounced at 150 USD. Away from these important dates, on ‘ordinary’ dates the differences are still significant at between 3 and 6 USD per million traded. Using misleading forwards data on a roll, especially a large one, is a big problem for an asset manager, as well as for its investors.

Chart 1: Histogram of differences in USD per million dollars traded between NCFX Forwards365 and straight-line calculation in EURUSD

Chart 2: Histogram of differences in USD per million dollars traded between NCFX Forwards365 and straight-line calculation in AUDUSD

Chart 3: Histogram of differences in USD per million dollars traded between NCFX Forwards365 and straight-line calculation in GBPUSD

New Change has the solution!

Make sure you are taking advantage of the best available information to avoid overpaying or missing savings on the most significant part of your portfolio. New Change has the tools to help you assess your live pricing, select roll dates, as well as to get realistic feedback after trades.

To get in touch with us, email us at info@newchangefx.com or

To book a 30 min demo of our tools click here!

Corporate Responsibility. NCFX adheres to the principles set out in the following international codes of ethical conduct: OECD Guidelines for Multinational Enterprises, UN Global Compact, UN Guiding Principles on Business and Human Rights, ILO Conventions: Child Labour (C138, C182); Forced Labour (CO29, C105); Discrimination (C100, C111); Freedom of Association (CO87, C098).

© 2024 New Change FX. All rights reserved.