Back to Market Insights

MAY 20, 2020

The Unit Cost of Volatility at the 4pm Fix

The 4pm Fix conducted in London is a seemingly immovable feature of the Foreign Exchange (FX) markets. The Fix is still widely used by corporations and asset managers, despite the controversy over the wisdom of its use. To provide a fresh look at the issue, NCFX has created a new measure of FX cost; the Unit Cost of Volatility (UCV) which provides a clear view of costs irrespective of prevailing volatility conditions. The results when we look at the Fix through this lens are startling.

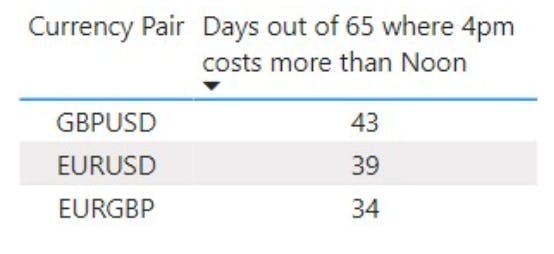

A common defence of the London 4 pm Fix is that FX effects do not really matter and come out in the wash. Harking back to the classic Meese and Rogoff paper in the early 80’s, defenders of the 4 pm fix cite the random nature of FX. You win some, you lose some. Our analysis shows a similar pattern:

This argument, whilst superficially compelling, fails to account for the systematic features of price action before and during the Fixing window, and what they might cost. Using a proprietary metric of the Unit Cost of Volatility (UCV) during the 4pm Fix and comparing it to the UCV of trading at midday we demonstrate a systematic skew in the cost/benefit outcome of participating in the 4pm Fix.

The idea of UCV comes from standard market impact theory. A general rule of thumb in trading is that it should cost one day’s volatility to trade one day’s volume. The intuition behind this is that risk exposure increases as a function of time. If it takes a day to clear a trade, the risk exposure of the trade is one day’s volatility. Because of the way volatility is calculated, the relationship of volatility to time is consistent over scale. The risk to clear a trade over 5 minutes is equal to 5 minutes volatility. UCV expresses transaction costs as a ratio of cost over volatility. Specifically, if we know the amount that is being traded, we can quantify the inventory risk in USD terms.

Several studies have already signalled the spike in volatility at the 4pm London close. What has been less well documented is the absolute price movement leading into the 4pm Fix. This is because there is a tendency to measure transaction costs against the instantaneous bid/offer spread at the moment of execution, rather than against spread and the movement in price between the moment an order is externalised to the market and the moment the order is filled. This latter is the true definition of market impact formalised by Perold’s Implementation Shortfall method.

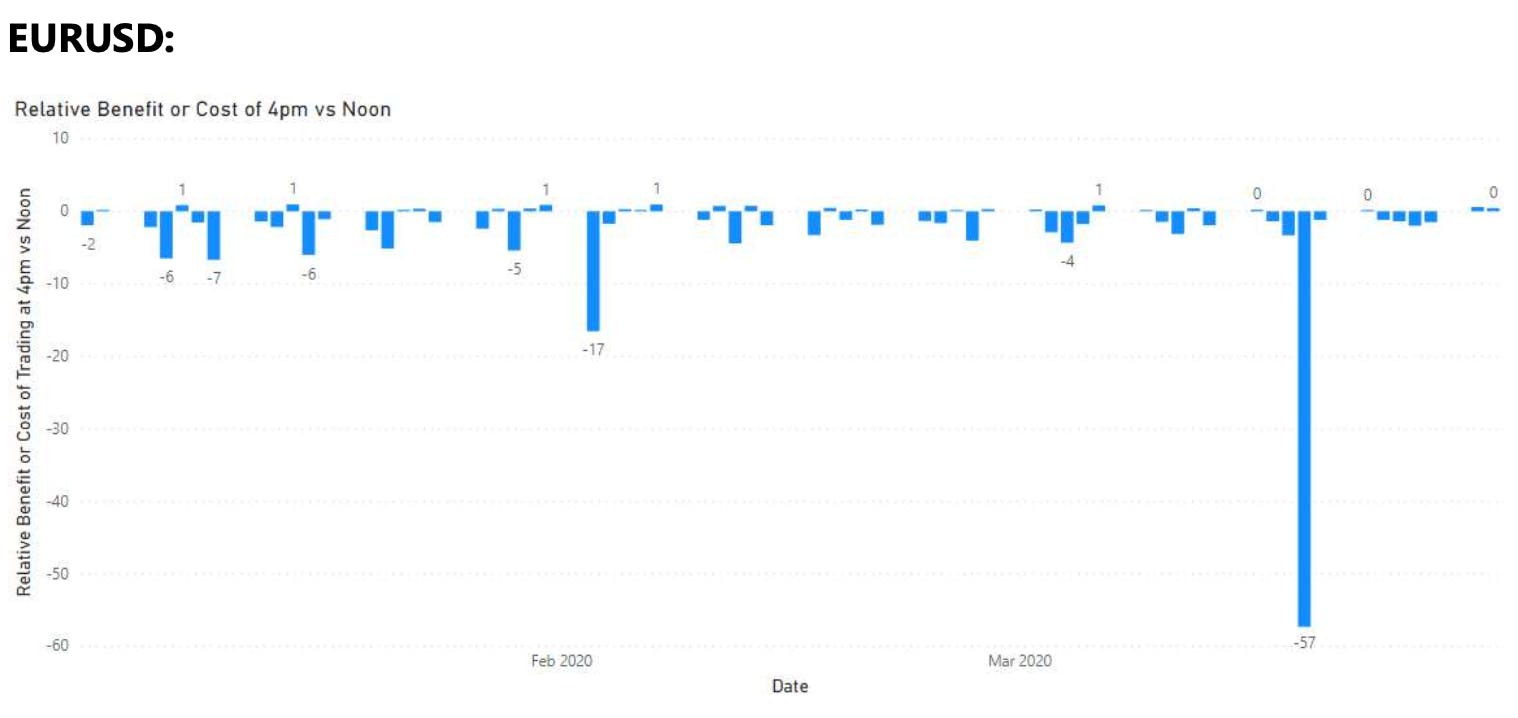

Given the well documented spike in volatility at 4 pm it follows then that the UCV of trading at the fix should be relatively low, or at least, not significantly greater than at other times of the day. Higher volatility in the denominator should decrease the ratio of cost to risk. This is not the case. The UCV of trading at the fix is higher. Defenders of the fix can get away (almost) with saying that about 50% of the time it is advantageous to trade at the Fix, but the difference between the costs and benefits of using the fix are massively skewed against users of the Fix. The benefits are small, and the costs are large.

We studied the cost benefit outcome of participating in the Fix over a three-month period between the 2ndJan 2020 to 31st March 2020 in EURGBP, EURUSD and GBPUSD. We calculated the 5-minute USD cost of volatility at the Fix and the 5-minute USD cost of volatility at midday. Orders for the Fix must generally be submitted at least 15 minutes before 4 pm. Accordingly we measure price action as the absolute change in price at 15 minutes prior to midday and 4 pm. We arrive at USD values by taking the average daily volumes of global FX turnover and adjusting these for the volume at the Fix. We assume net participation of approximately 3% of daily volume traded at the Fix. Greater participation rates do not change the UCV, nor do they change the quantum of difference between costs and benefits, they just make the USD numbers bigger.

In short, when we look at cost outcomes, we see that for every time participants are one dollar better off for having used the fix, they are 15 dollars worse off when the Fix goes against them. If the odds of a benefit or cost from using the Fix are 50:50 (they were worse during the sample), then these are the probabilities of ruin.

What are the consequences of this? Trades are completed as required and the index price may even have been achieved in the process. The problem is that Fix participants have fewer assets than if they had traded at some other time of day. If FX is simply driven by liquidity needs; i.e. if it is unimportant from a return perspective, then a serious effort should be made to ensure that FX is not actively damaging the portfolio.

It is important to bear in mind that the UCV methodology should by rights have shown the Fix to be at least no worse than at other times of the day. It is massively worse. Participants of the 4pm Fix need to abandon any pretence that participating in the Fix meets Best Execution requirements. Participation bears significant and systematic costs.

For more information about New Change FX, please contact: info@newchangefx.com

Corporate Responsibility. NCFX adheres to the principles set out in the following international codes of ethical conduct: OECD Guidelines for Multinational Enterprises, UN Global Compact, UN Guiding Principles on Business and Human Rights, ILO Conventions: Child Labour (C138, C182); Forced Labour (CO29, C105); Discrimination (C100, C111); Freedom of Association (CO87, C098).

© 2025 New Change FX. All rights reserved.