Back to Market Insights

MAR 19, 2020

Why Market Impact Matters

Independent Benchmark Mid-Rates for Foreign Exchange

The use of benchmarks is widely accepted in both everyday life and in the world of professional investments. Mortgage interest rates are based on a central bank benchmark rate. Investment returns are measured against benchmark returns. The benchmark provides a reference against which the quality and cost of a choice can be assessed. Making investment or spending choices without an understanding of cost would seem foolhardy at best.

In the world of Foreign Exchange however the concept of benchmarking is very often absent, and where present, very poorly implemented. The argument goes that the Foreign Exchange market is very deep and liquid, so it doesn’t really matter as costs are low. We disagree strongly.

Liquidity.

The latest BIS data from 2019 tells us that the FX market excluding swaps and options transacts just under USD 3 trillion per day globally. This huge sum leads to a fundamental misconception – that the FX markets are very liquid, and by implication, cheap to trade. Why do we say this? It is apparent that most FX transactions are handled electronically today. Technology providers (Arista, Cisco etc) now talk in terms of nanoseconds to identify and execute transactions. This means that we need to adjust our understanding of what “time” means, when we refer to the liquidity available at the time we wish to trade.

This calculation yields startling results. EURUSD is the most widely traded pair, and it represents 24.03% of all volume reported to the BIS in 2019. If we then weight volume by the hour through a 24-hour trading cycle, we find that the busiest time of day is the hour from 3 to 4pm London time, where approximately 9.2% of a trading day’s volume is executed. That gives approximately 66 billion dollars’ worth of EURUSD available during that hour, or roughly USD 18.3 million per second. Bear in mind that 18.3 million Dollars per second is all that is available across the entire market. The biggest banks in FX each represent less than 10% of the market, so the naturally available (i.e. without creating market impact) volume via the FX banks with the largest share of the market is less than 2 million dollars a second. FX is illiquid.

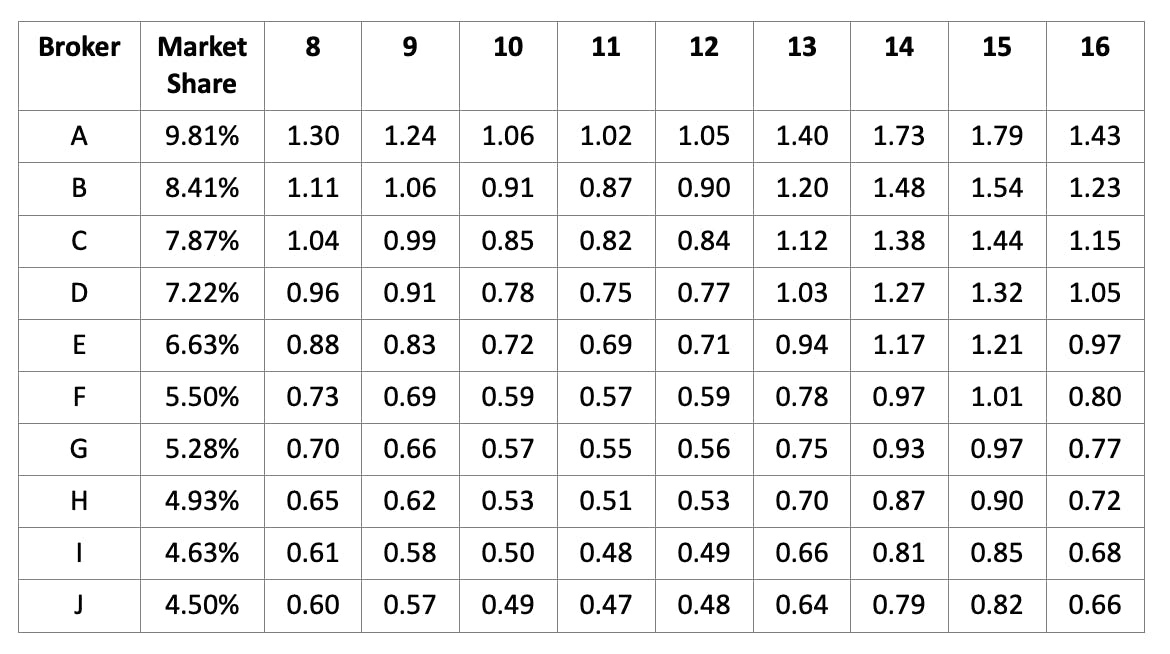

Availability of liquidity, top 10 brokers by Euromoney volume, per second average of USD in millions, London time:

Why Does This Matter?

Once the liquidity issue is understood in terms of an absence of liquidity, the complexion of FX trading changes. When a client asks a bank for a price the bank must either hold the position against their inventory or cover the risk in the market. Bank policies nowadays tend to require that very little risk is held, so in the main, transactions are fed through the bank into the market. Should the amount being traded be above the amounts outlined above (the natural absorption rate) then the trade will necessarily be pushed into the market, which creates a disequilibrium in the market, known as market impact.

Market Impact.

Market impact is the effect that a client’s trade has on the market. Market Impact is split into temporary and permanent components – the temporary component is the spread experienced by the client which is a cost that is not shared by the market, and permanent impact is the change caused by the transaction in the equilibrium price (mid-price) of the market. The permanent impact is experienced by all market users, changing the mid-rate around which bids and offers are created.

Market Impact is faced by any market user, either directly where the client uses the bank as a conduit to access the market via an algorithm for example, or indirectly when a risk-transfer price is requested. The risk transfer price reflects the dealer’s expectation of market impact and is a component of the spread made to the client. This happens whether the dealer experiences the priced market impact or not. This common experience means that evaluating market impact is key to the correct evaluation of liquidity providers.

Market Impact is not the only component in evaluating the cost of a transaction, but it is key to understanding the quality of a liquidity provider (LP). LPs spend years developing their networks so that they are able to supply liquidity to clients. LPs that do a good job of this have lower market impact scores than those that do not. Understanding the market impact of a dealer is therefore key to evaluating their quality.

Evaluating Liquidity Providers.

The evaluation of liquidity providers is often reduced to the simplicity of calculating what the market did next and evaluating the transaction against random points after the transaction. This ‘mark out’ is often supplied by the broker as a form of TCA using the same price feed on which the transaction was created.

This creates two problems. Firstly, the feed that has been directly impacted is being used to measure the impact. This will cloak some of the impact as the reference point already contains the trade that needs to be measured. This problem has been referred to as Finance’s analogue of the Heisenberg Uncertainty Principle. You can only measure market impact by comparing the price after trading to the price that would have been there without your trading. Measuring market impact against the same feed compares the traded price against the traded price. When we trade we move the price. If I take the price after I have traded to measure my impact, I will miss the impact my asking for a price created. The price movement I am trying to capture has already been included in the price.

Secondly each liquidity provider is being measured against their own liquidity, so there is no read-across to accurately compare LP 1 and LP 2.

Similarly, where a broker understands how they will be measured, for example against the feed provided by a single bank or platform, they will use that bank or platform to exit risk so that they are once again compared to the impacted feed, rather than a feed that they have not impacted. This is why MiFID 2 specifically rules out using data from single sources when measuring costs.

Assessing the cost of market impact depends on the presence of an independent rate in the process. As discussed, without a data feed from outside the process, market impact costs are being cloaked, and brokers are not being assessed on a common basis. Whereas in equities, this paradox is mitigated by the presence of a consolidated market tape, the FX market has been slower to recognise how well market impact costs have been shrouded.

In fact, the fragmented nature of the FX market lends itself rapidly to a solution that reaggregates liquidity, and compares trades against a neutral, aggregated composite of the market, containing data collected from multiple feeds, not just one. Against an independent feed, market impact is simply the difference between the traded price and aggregate mid when the order was submitted.

As we recognised earlier, market impact costs are impounded in the spreads that clients pay when they come to market. Market makers will adjust their spread in anticipation of client orders, competing with each other to capture the market flow. The spread that dealers charge has several components. Spreads are driven by estimations of the risk to cover the position, as well as considerations that are specific to each client and each transaction. Some times spreads are negligible because a client deal is in the favour of the market maker. A client is looking to buy when the market is trending lower, allowing the market maker to buy back their sale at a lower price, or cover an existing open position with an incoming trade.

Corporate Responsibility. NCFX adheres to the principles set out in the following international codes of ethical conduct: OECD Guidelines for Multinational Enterprises, UN Global Compact, UN Guiding Principles on Business and Human Rights, ILO Conventions: Child Labour (C138, C182); Forced Labour (CO29, C105); Discrimination (C100, C111); Freedom of Association (CO87, C098).

© 2025 New Change FX. All rights reserved.